Keeping track of your mortgage amortization schedule is very important to avoid foreclosures or repossession of the property you used to secure the loan. This aspect of mortgage loans makes it different from the other types of amortized loans. The lender has the right to foreclose or repossess the property on collateral if payments are not made on your mortgage. You need to keep up with your repayments to avoid losing your home. Mortgages are secured with a collateral, which is commonly a house or a property. If the borrower is credit-worthy, then the mortgage loan is approved, otherwise it is denied. They are credit, capacity, and collateral. The risks and terms that underwriters mostly consider fall under what is called the three Cs of underwriting. A mortgage underwriter analyzes the borrower’s credit worthiness. It is the process that a lender uses to determine if the borrower is capable of paying the mortgage.

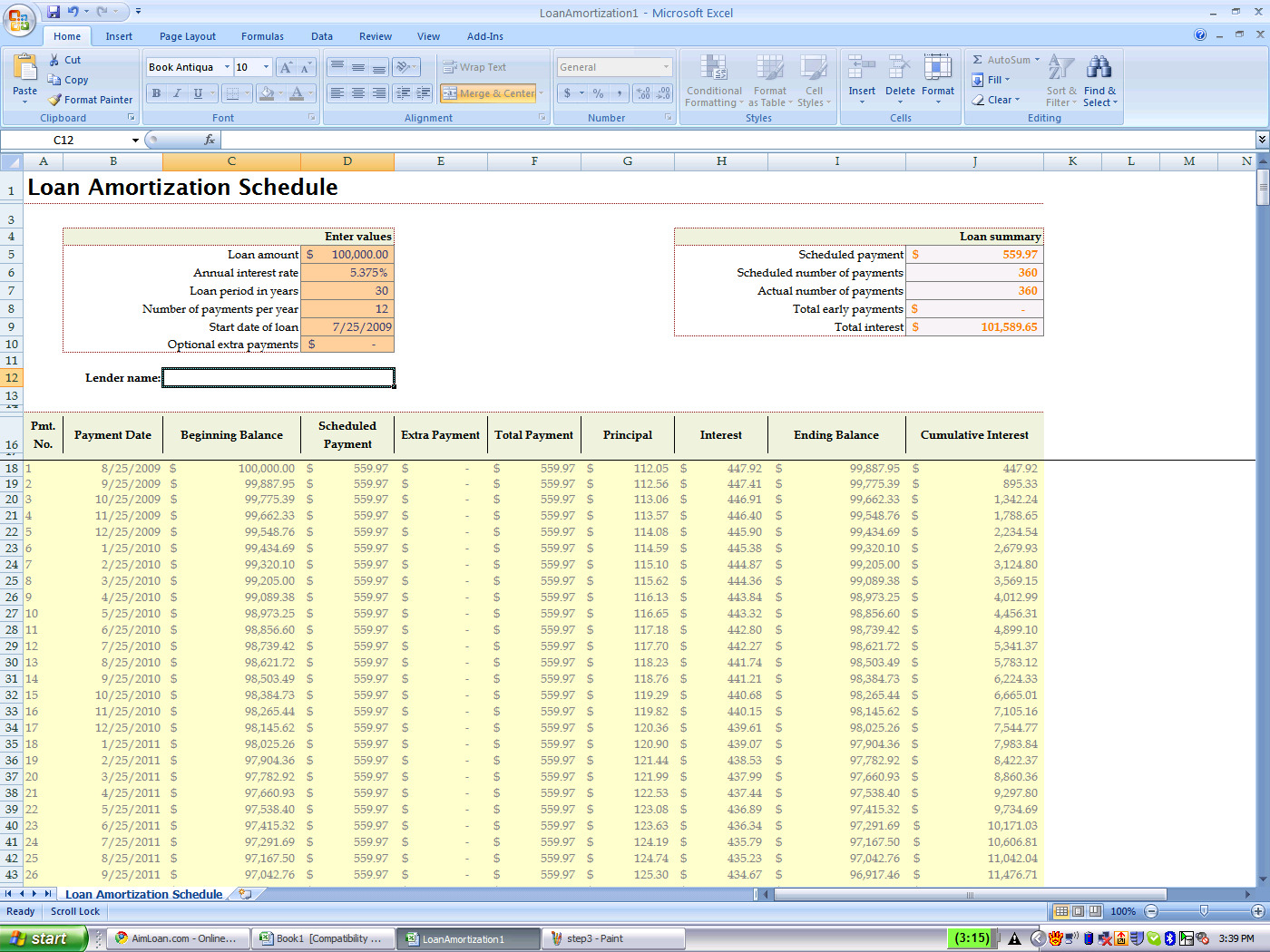

Mortgage Calculator Amortization Schedule in Excel We also have these helpful tools namely the Amortization Schedule Calculator Samples, Amortization Table Excel Samples, and Loan Amortization Calculator Templates to get you going with your amortization needs.

Part of the interest rate risk is transferred from the lender to the borrower, that is why it is widely used. Variable Rate Mortgage – The interest rates changes or fluctuates over time based on an index.A fixed rate funding is expensive and hard to obtain. Fixed Rate Mortgage – The interest rate of the mortgage stays the same or is fixed for a number of years.

0 kommentar(er)

0 kommentar(er)